Banking Mobile App

Native iOS & Android mobile apps

As a senior product designer at First National Bank of Omaha (FNBO), a large regional bank, I led the effort to update the design of the existing mobile banking app.

The initial design of the app had been contracted to an external agency and was not well received upon launch. The app lacked several key features, and its design looked dated despite being a brand new app.

My goal was to improve the overall user experience and incorporate several table-stakes features that were missing from the existing app.

UX Research, UI Design

First National Bank of Omaha (FNBO)

2021 - 2024

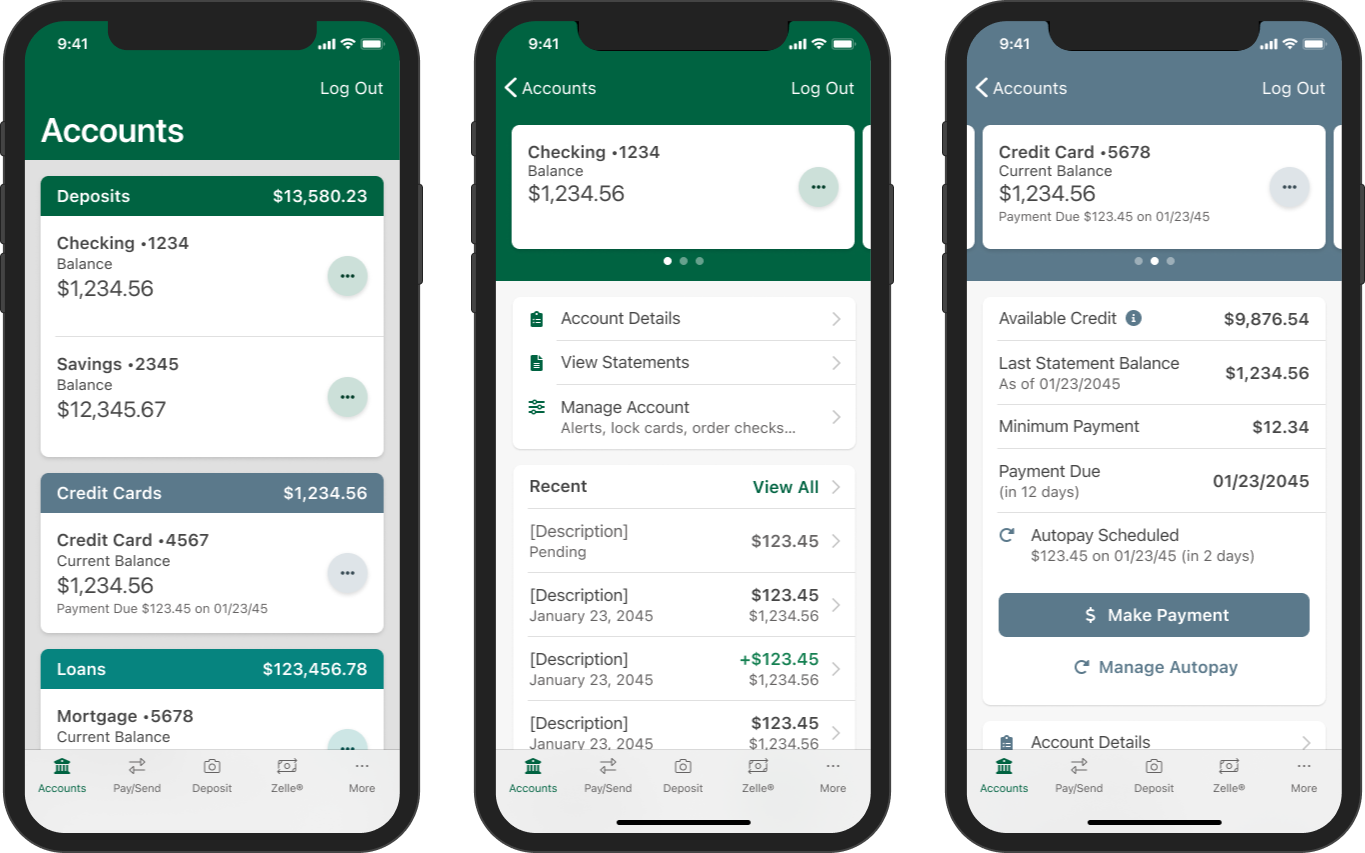

Old Design

Updated Design

Process

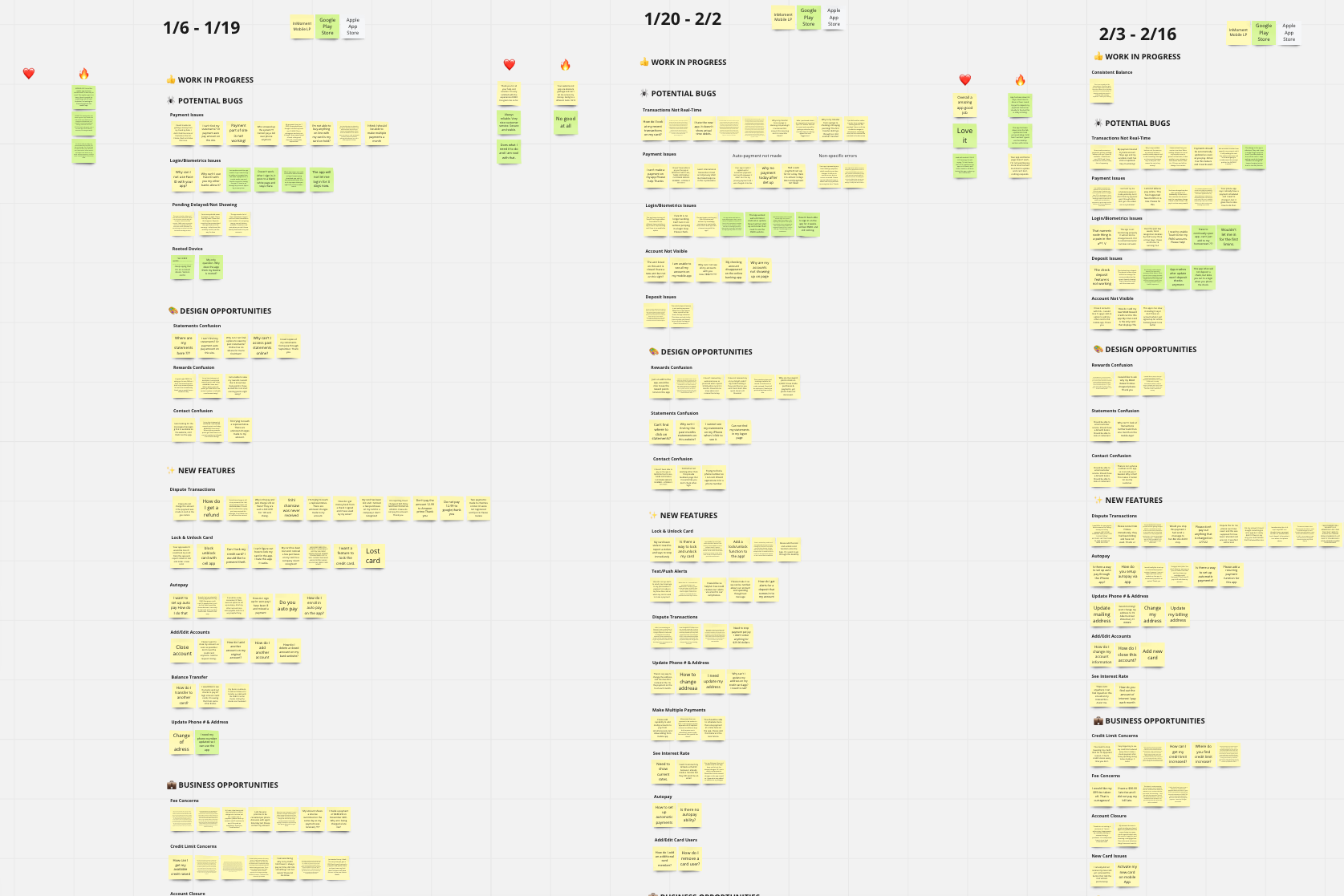

Over an 18 month period, I regularly gathered user feedback from within the app and from the app stores. This gave me a good idea of what features were still missing and where pain points were occurring with current features. I performed extensive competitive analysis by looking at the mobile apps of other large banks and noticed patterns emerge.

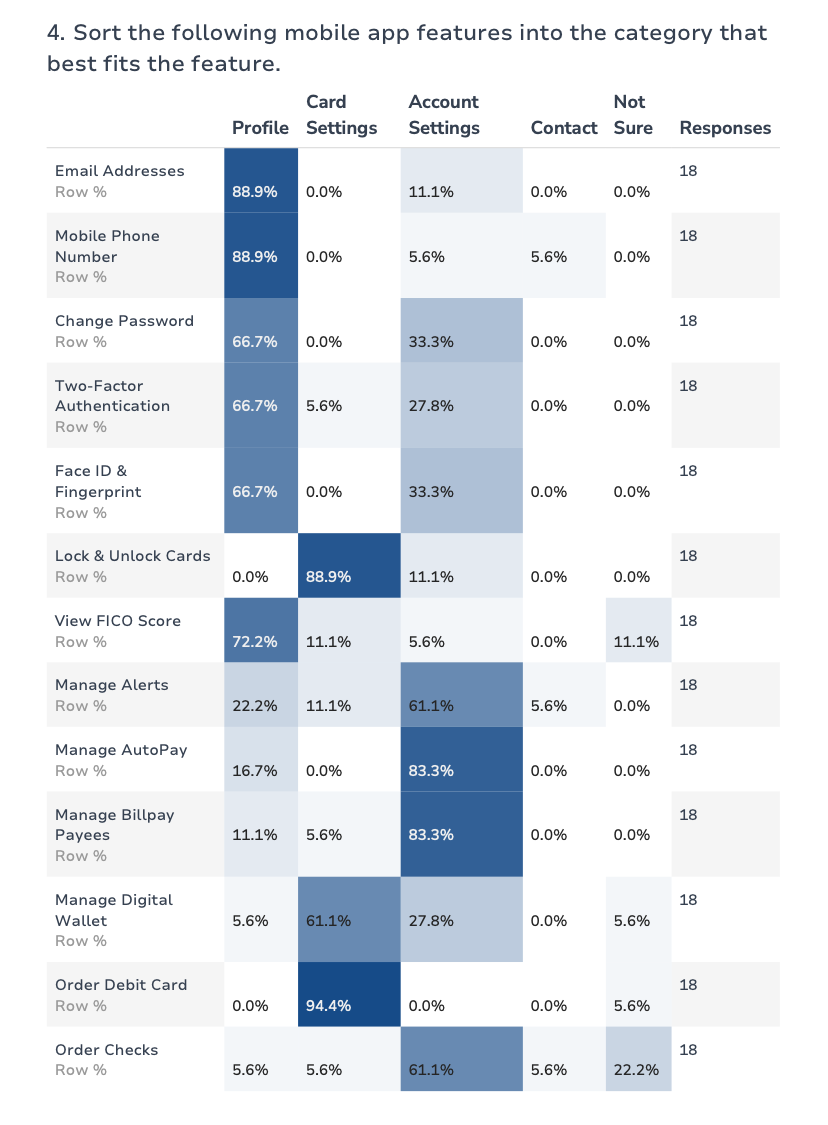

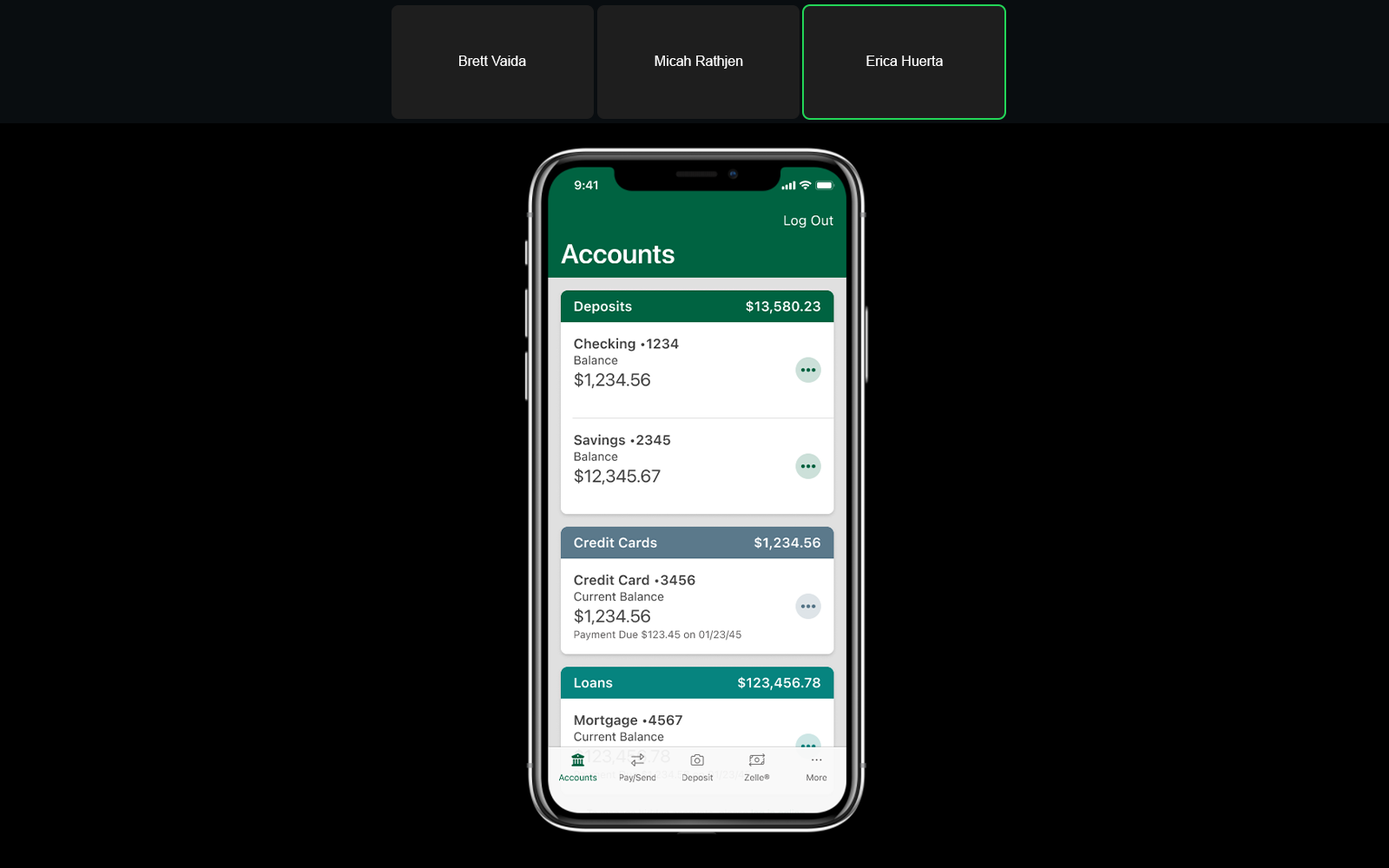

I also met with several key stakeholders within the bank to make sure this redesign work would be prioritized and not interfere with other ongoing business efforts. Initial wireframes were then completed and tested in collaboration with a UX researcher on my team. We sent out hundreds of user surveys and conducted dozens of user interviews to make sure we were headed in the right direction.

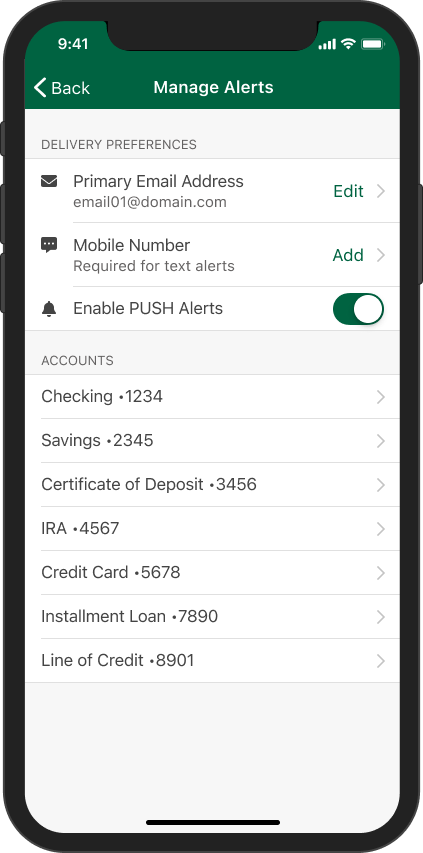

Users helped us identify several pain points in the app, such as how the current design made it difficult to visually differentiate between account types and some basic money movement features were hard to find. The app also lacked basic features like the ability to set up autopay for credit cards and loans, real-time notifications, or being able to dispute transactions without calling into the call center.

Solutions

-

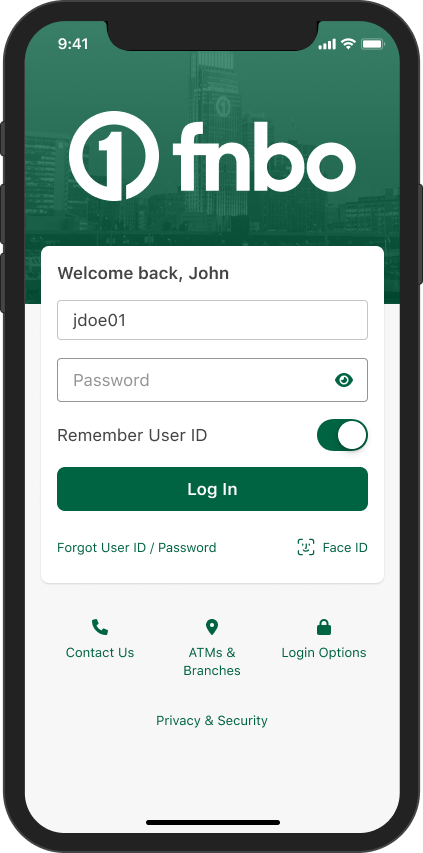

Personalized Login

Friendly and personalized login messages as well as quick access to Face ID

-

Account Groups

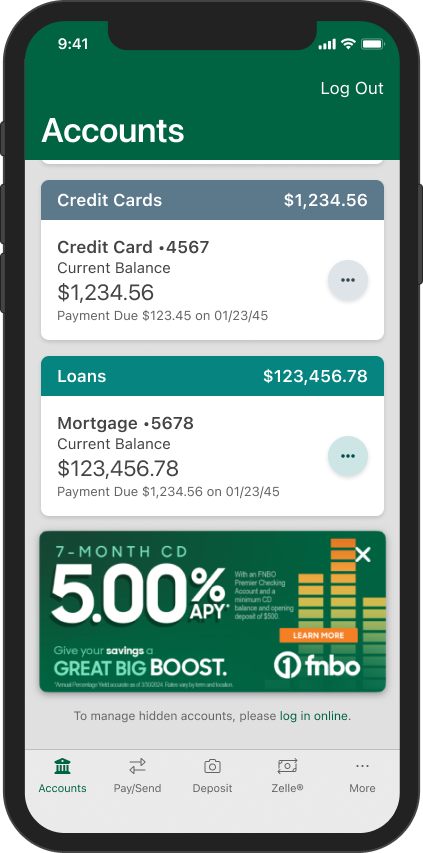

Grouped and color-coded accounts by type for easy scanning and context switching

-

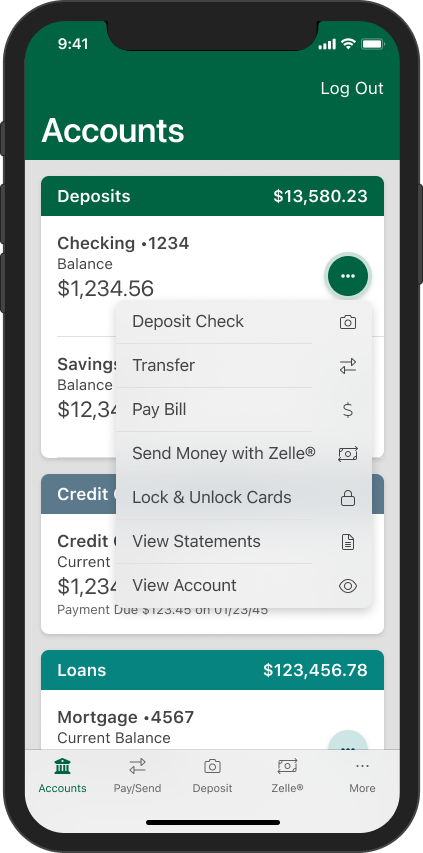

Quick Actions

Consolidated the most commonly used account features into a dynamic pulldown menu

-

Marketing Personalization

Introduced dynamic marketing card to provide cross-sell opportunities tailored to each user

-

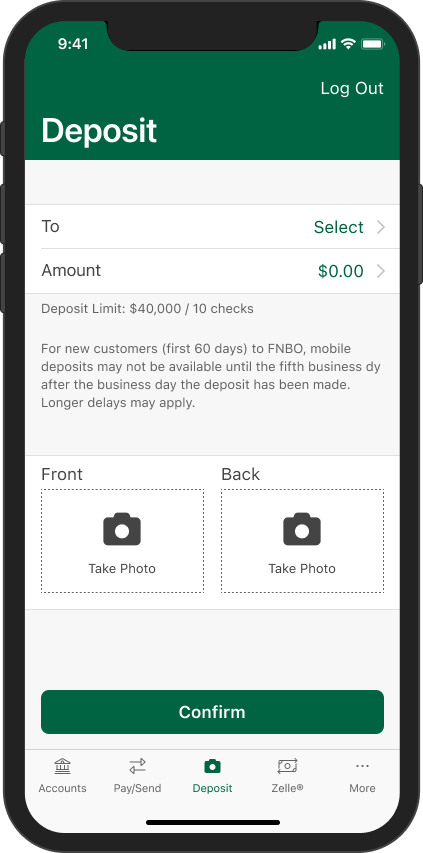

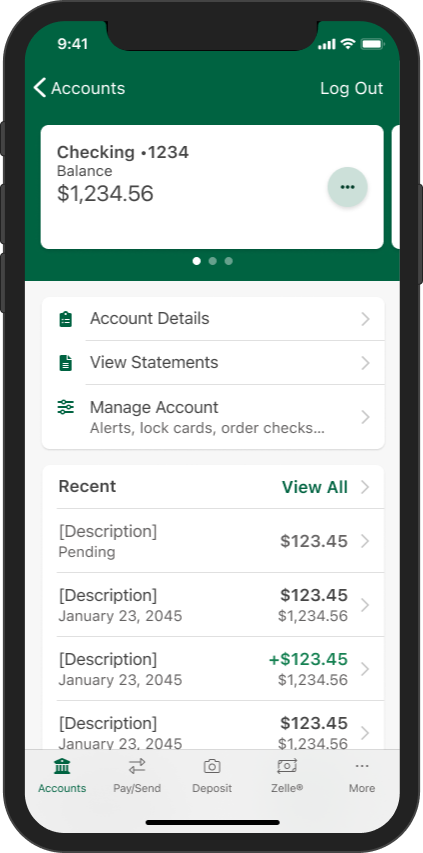

Intuitive Navigation

Refactored bottom navigation to make top-level features like Deposit and Zelle® transfers easier to find

-

Updated Summary

Allowed users to quickly find the account actions they’re looking for and scan recent transactions

-

Improved Payments

Added a dedicated payments section to the account summary, including Autopay functionality

-

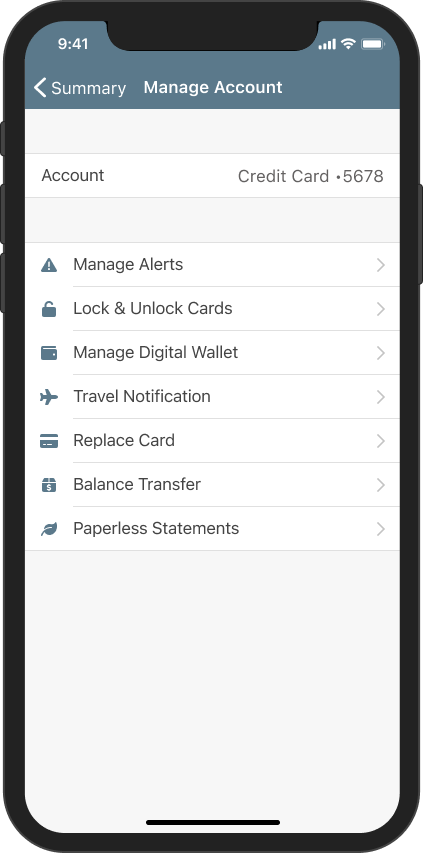

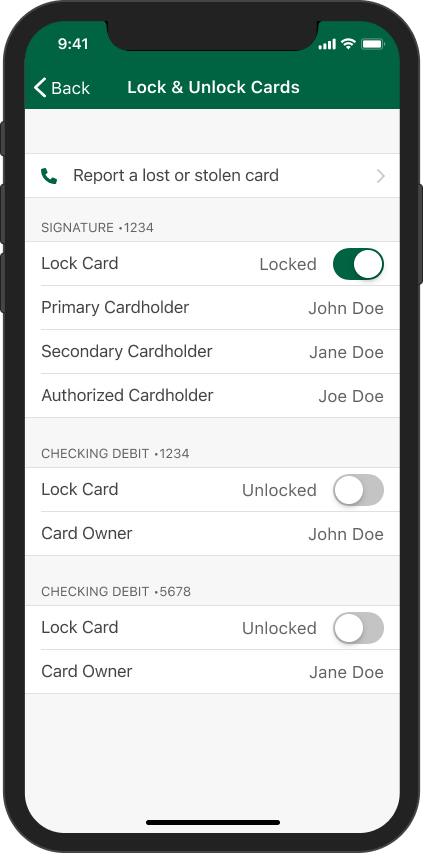

Easier Account Actions

Made tucked away features like statements, rewards, and lock/unlock cards easier to find

-

Search Transactions

Implemented a search bar for users to narrow down specific account activity

-

PUSH & Text Alerts

Introduced several real-time alerts for credit card customers, increasing security and peace of mind

-

Lock & Unlock Cards

Provided the ability for users to lock and unlock their credit and debit cards to prevent fraud

-

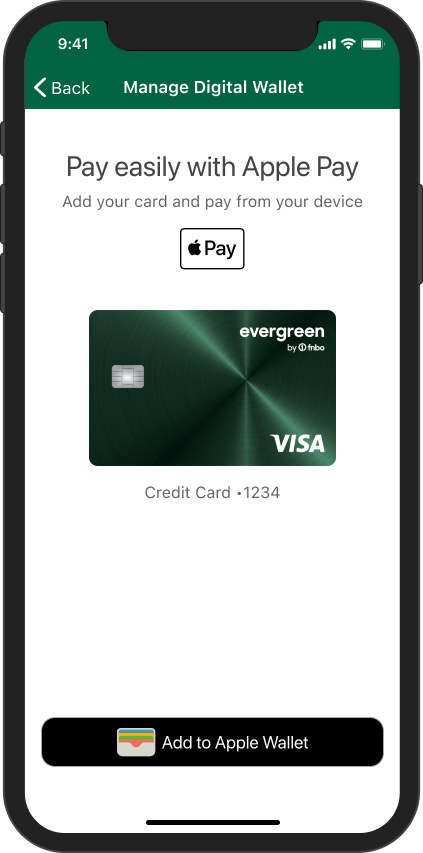

Digital Wallet

Created an onboarding process for users to add their credit cards to digital wallets like Apple Pay

Outcome

The redesigned FNBO mobile app received positive feedback and a 16% increase in overall user engagement. Mobile deposit inflows nearly doubled, resulting in tens of millions of dollars worth of additional assets for the bank. The app’s user ratings increased from 2.3 to 4.7 stars for iOS and 3.3 to 4.7 stars for Android, demonstrating clear customer satisfaction.